I recently came across some useful resources that I thought I would share with you all. These resources pertain to certain forms that are required for various aspects of employment and business. While these forms may seem confusing and tedious at first, understanding their purpose can help streamline certain processes and ensure that your business is in compliance with legal regulations. Here are some of the forms I found particularly useful:

Form I-9

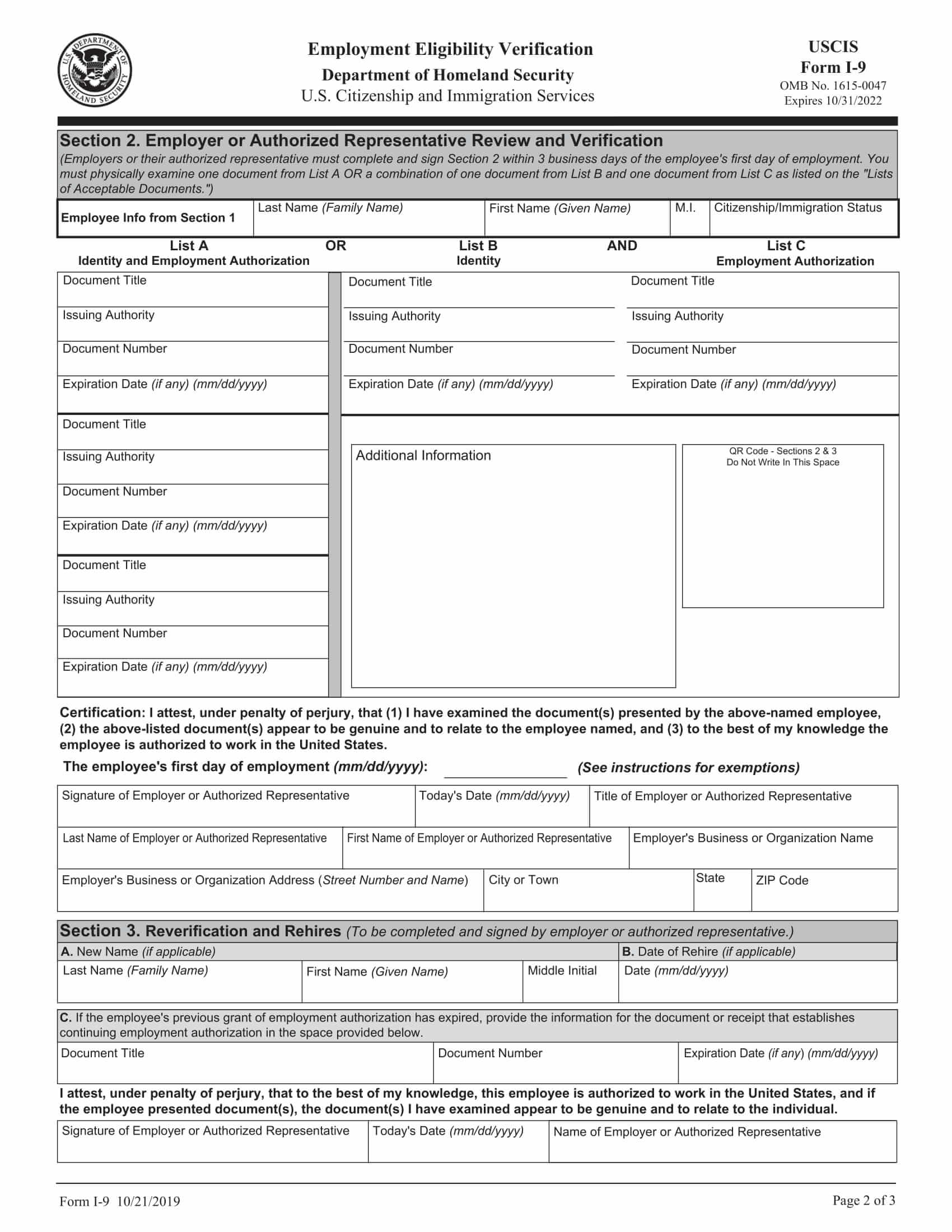

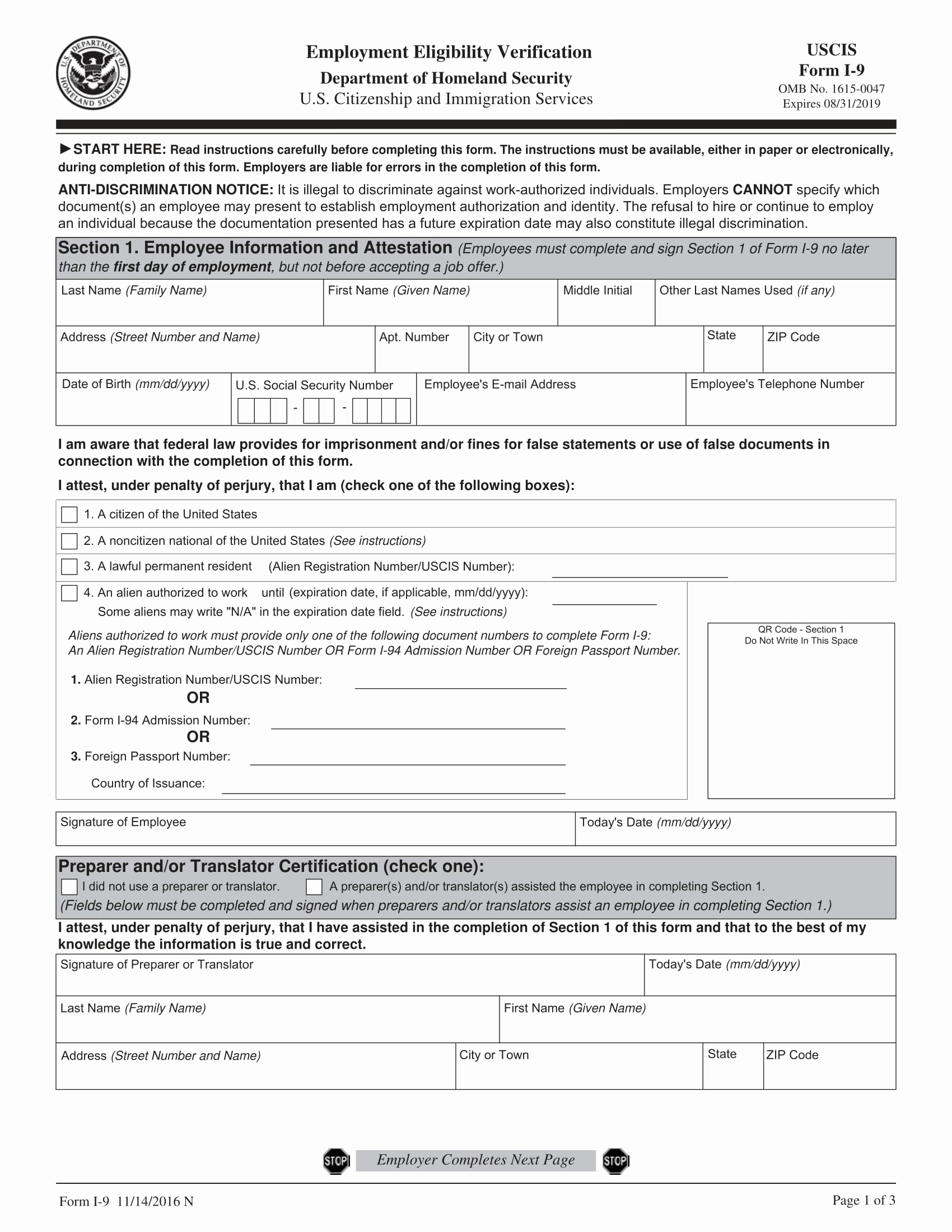

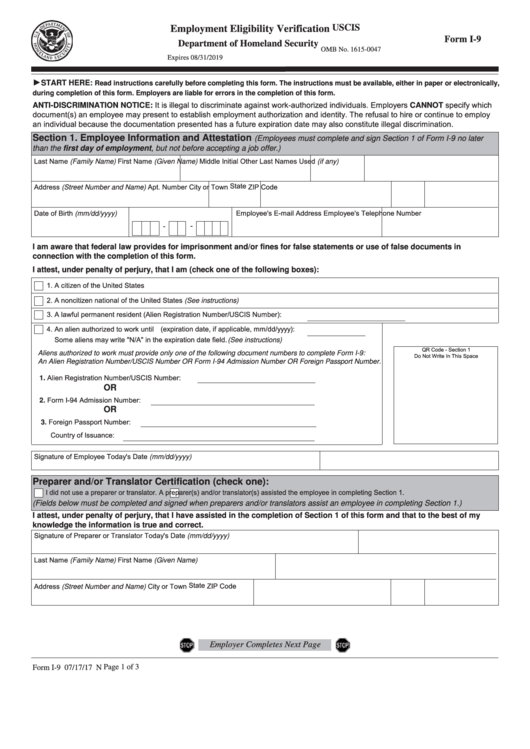

One of the most important forms for employers to understand is Form I-9. This form is used to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must ensure proper completion of Form I-9 for each individual they hire for employment in the United States, including both citizens and noncitizens.

One of the most important forms for employers to understand is Form I-9. This form is used to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must ensure proper completion of Form I-9 for each individual they hire for employment in the United States, including both citizens and noncitizens.

The form consists of three sections: Section 1 is completed by the employee at the time they are hired, Section 2 is completed by the employer within three business days of the employee’s start date, and Section 3 is completed by the employer if the employee’s employment authorization requires reverification. It is important to make sure that the form is filled out completely and accurately to avoid potential legal issues.

W-9 Form

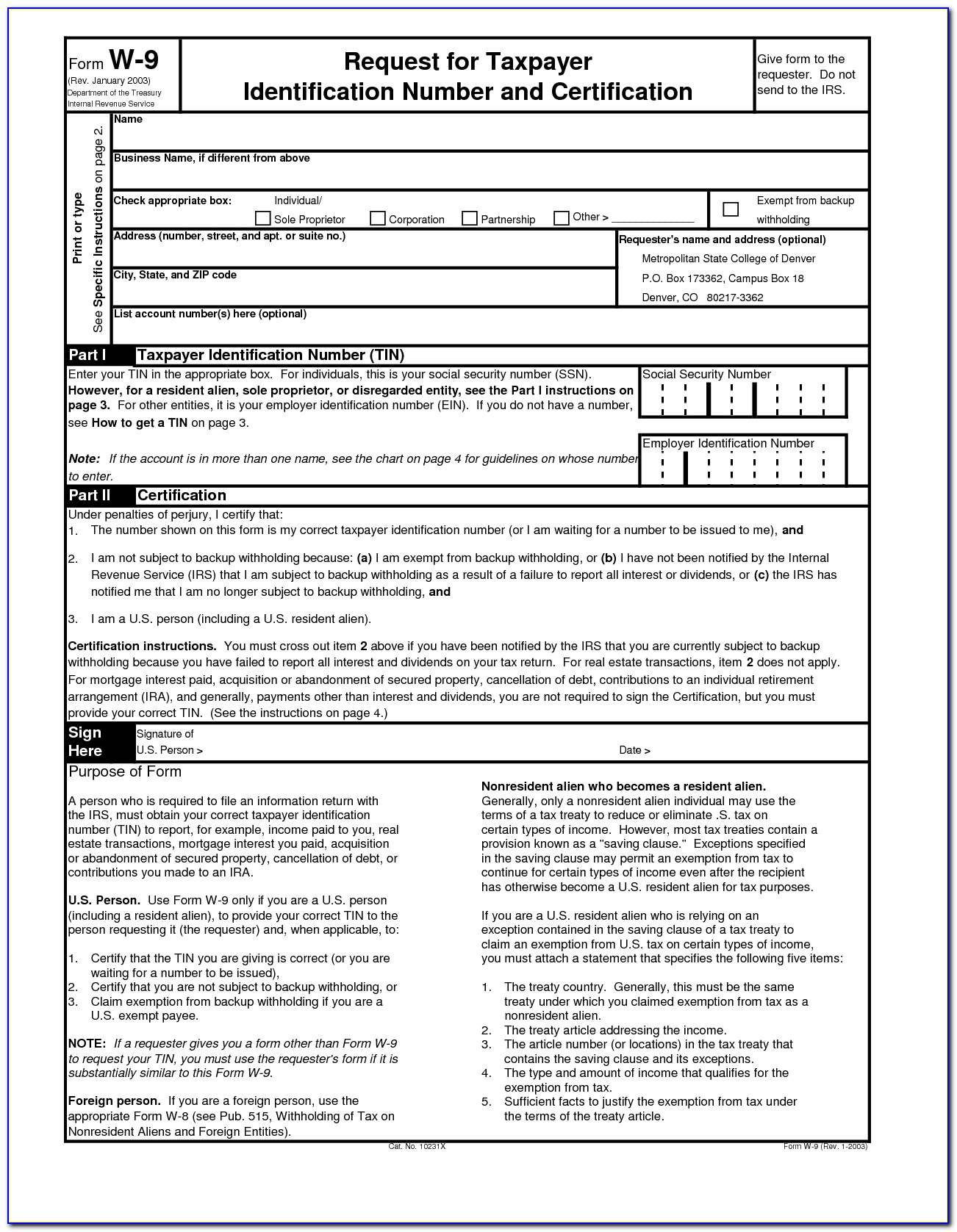

The W-9 form is used by businesses to request taxpayer identification information from independent contractors, freelancers, and other non-employees for tax purposes. The form is relatively straightforward, with only a few lines for the individual to fill out, but it is important to ensure that the information is accurate to avoid issues with the IRS.

The W-9 form is used by businesses to request taxpayer identification information from independent contractors, freelancers, and other non-employees for tax purposes. The form is relatively straightforward, with only a few lines for the individual to fill out, but it is important to ensure that the information is accurate to avoid issues with the IRS.

One important thing to note is that businesses are required to send a copy of the W-9 to the individual who filled it out and to the IRS. Make sure to keep a copy on file in case you ever need to refer back to it.

Form 1099

The Form 1099 is another tax-related form that businesses may need to complete. This form is used to report various types of income that are not classified as wages, salaries, or tips, such as payments made to independent contractors, rent paid, or royalties earned.

The Form 1099 is another tax-related form that businesses may need to complete. This form is used to report various types of income that are not classified as wages, salaries, or tips, such as payments made to independent contractors, rent paid, or royalties earned.

If you paid an independent contractor $600 or more for their services during the year, you are required to send them a 1099 form and submit a copy to the IRS. Make sure to keep accurate records of any payments made so you can fill out the form correctly.

Business License

Depending on the nature of your business and where it is located, you may be required to obtain a business license. A business license is a permit issued by a government agency that allows individuals or companies to conduct business within a certain geographic area.

Depending on the nature of your business and where it is located, you may be required to obtain a business license. A business license is a permit issued by a government agency that allows individuals or companies to conduct business within a certain geographic area.

The requirements for obtaining a business license vary by location and business type, but typically involve filling out an application and paying a fee. Make sure to research the requirements in your area and ensure that you are in compliance with any regulations.

Conclusion

Understanding and properly completing these forms can help streamline various aspects of employment and business. While it may seem daunting at first, taking the time to ensure that everything is filled out properly can save you a lot of headaches in the future.

Understanding and properly completing these forms can help streamline various aspects of employment and business. While it may seem daunting at first, taking the time to ensure that everything is filled out properly can save you a lot of headaches in the future.

Remember, it’s always better to be proactive and ensure compliance with legal regulations than to deal with potential legal issues down the road.

If you have any questions about these forms or other legal requirements for your business, it’s always a good idea to consult with a legal professional who can provide guidance and advice specific to your situation.

Thanks for reading, and good luck with your business endeavors!