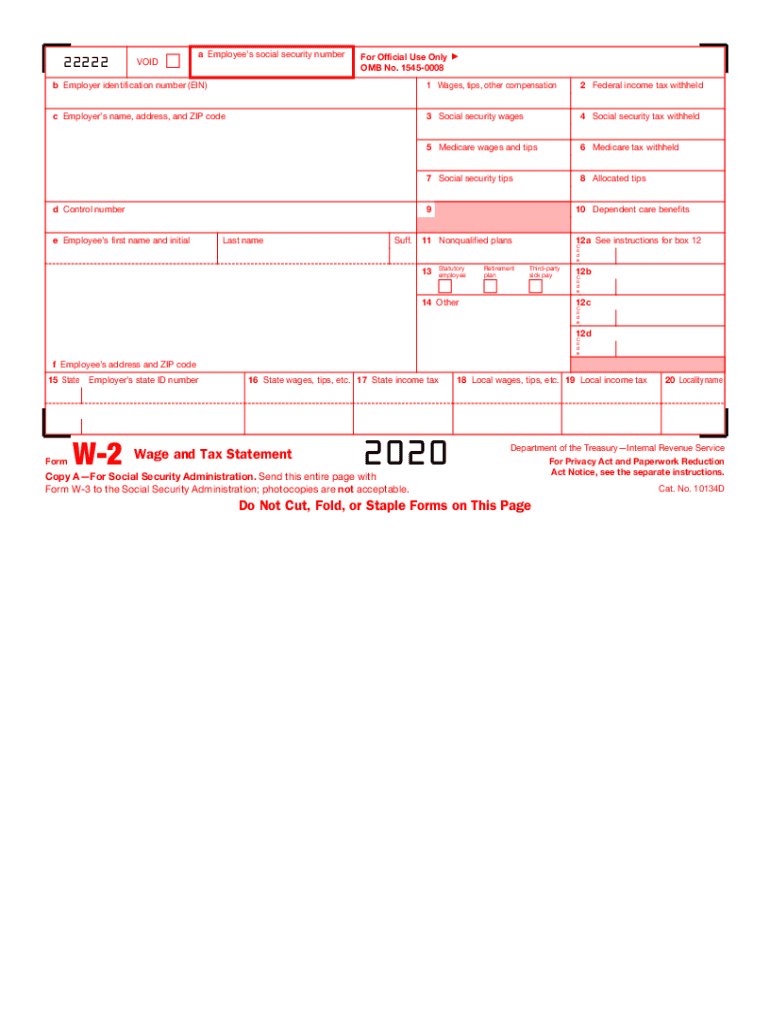

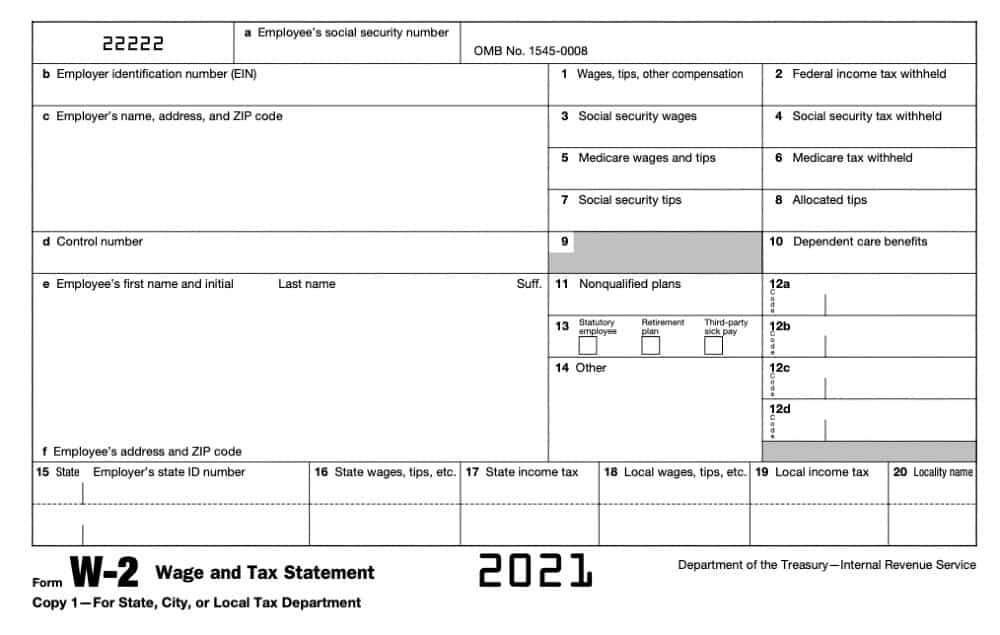

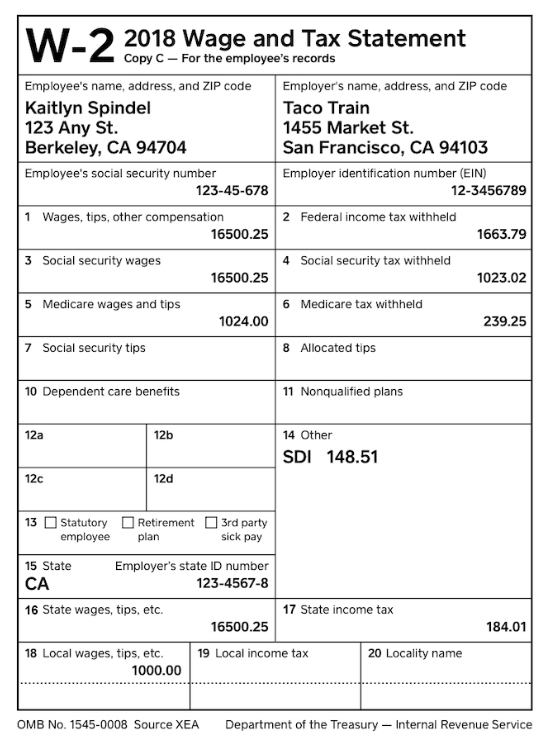

The W2 form is an essential document that every employee receives at the end of each tax year. It contains important information about the employee’s income and the taxes that were withheld during the year. This information is necessary for the employee to file their income tax returns accurately. In this post, we will take a closer look at the W2 form and how to fill it out correctly.

What is a W2 Form?

A W2 form is a tax document that an employer provides to their employees at the end of each calendar year. It shows the employee’s total taxable income, as well as the amount of federal, state, and local taxes that were withheld from their paychecks. It’s important to note that the W2 form is used for employees who were paid wages or a salary during the tax year.

When you receive your W2 form from your employer, you should check it carefully to make sure that all of the information is correct. If you notice any errors, you should contact your employer immediately to have them corrected. It’s important to file an accurate tax return, and any errors on your W2 form could result in penalties or an audit from the IRS.

When you receive your W2 form from your employer, you should check it carefully to make sure that all of the information is correct. If you notice any errors, you should contact your employer immediately to have them corrected. It’s important to file an accurate tax return, and any errors on your W2 form could result in penalties or an audit from the IRS.

How to Fill Out a W2 Form

The W2 form may seem overwhelming at first, but it’s actually quite easy to fill out if you follow these simple steps.

### Step 1: Obtain the Correct Form

### Step 1: Obtain the Correct Form

The first step to filling out your W2 form is to obtain the correct form from your employer. You may also be able to download the form from the IRS website if you need an additional copy. It’s important to make sure that you have the correct form for the tax year you are filing for.

Step 2: Enter Your Personal Information

The next step is to enter your personal information, including your name, address, and Social Security number. It’s important to make sure that this information is accurate and matches the information on file with the Social Security Administration.

Step 3: Enter Your Employer’s Information

You will also need to enter your employer’s information, including their name, address, and Employer Identification Number (EIN). This information is typically provided on your pay stubs or on your employer’s website.

Step 4: Enter Your Wage and Tax Information

Now it’s time to enter your wage and tax information. This information is broken down into several boxes on the W2 form:

- Box 1: Wages, tips, and other compensation

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

- Box 7: Social Security tips

- Box 8: Allocated tips

- Box 9: Blank

- Box 10: Dependent care benefits

- Box 11: Nonqualified plans

- Box 12: Various codes that indicate different types of compensation or benefits

- Box 13: Checkboxes for statutory employee, retirement plan, and third-party sick pay

- Box 14: Other

- Box 15: State and employer’s state ID number

- Box 16: State wages, tips, etc.

- Box 17: State income tax withheld

- Box 18: Local wages, tips, etc.

- Box 19: Local income tax withheld

It’s important to make sure that all of this information is correct and matches the information on your pay stubs. You should also double-check to make sure that the amounts in Boxes 2, 4, 6, and 17 are correct. These are the amounts that were withheld for federal income tax, Social Security tax, Medicare tax, and state income tax, respectively.

### Step 5: Verify Your Information and File Your Taxes

### Step 5: Verify Your Information and File Your Taxes

Once you have filled out your W2 form, you should verify that all of the information is correct and complete. If everything looks good, you can file your taxes using the information on your W2 form. Be sure to keep a copy of your W2 form for your records, as well as copies of all of your pay stubs for the tax year.

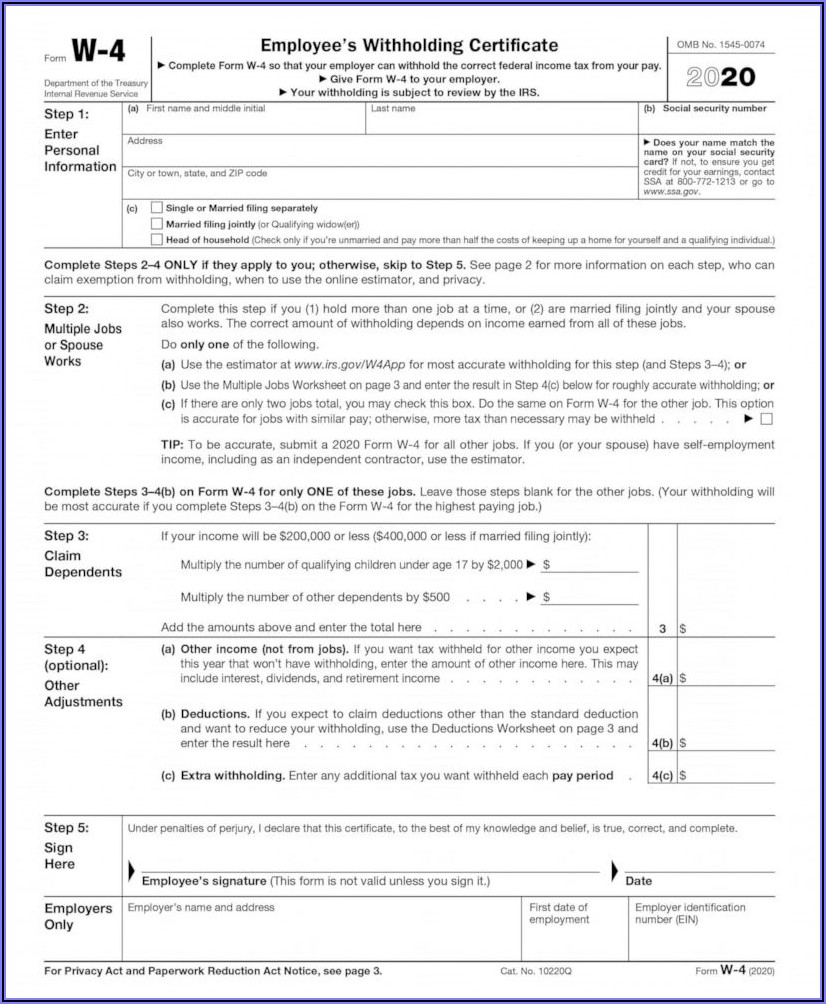

What’s New on the 2020 W2 Form?

Each year, the IRS may make changes to the W2 form to reflect changes in tax laws or other factors. Here are some of the changes that were made to the 2020 W2 form:

- Box 9 is now blank. This box was used in previous years to indicate whether the employee participated in a sick pay plan.

- The deferred compensation codes in Box 12 have been changed to be more specific and easier to understand.

- The Additional Medicare Tax is now included in Box 6, rather than having its own box.

- The instructions for Box 14 have been updated to include more information about state disability insurance (SDI) and state family leave insurance (FLI).

- There is a new reporting requirement for certain types of non-qualified deferred compensation plans.

It’s important to stay up-to-date on any changes to the W2 form or other tax forms. This will help ensure that your tax returns are accurate and that you do not run into any issues with the IRS.

It’s important to stay up-to-date on any changes to the W2 form or other tax forms. This will help ensure that your tax returns are accurate and that you do not run into any issues with the IRS.

FAQs About the W2 Form

Here are some frequently asked questions about the W2 form:

What if I don’t receive a W2 form from my employer?

If you do not receive a W2 form from your employer by January 31st of the following year, you should contact your employer immediately to have them issue a duplicate form. If your employer refuses to issue a W2 form, or if you cannot get in touch with your employer, you should contact the IRS for assistance.

What if the information on my W2 form is incorrect?

If you notice any errors on your W2 form, you should contact your employer immediately to have them corrected. It’s important to file an accurate tax return, and any errors on your W2 form could result in penalties or an audit from the IRS.

Do I need to attach my W2 form to my tax return?

No, you do not need to attach your W2 form to your tax return. However, you should keep a copy of your W2 form with your tax records for at least three years.

### Can I file my taxes without a W2 form?

### Can I file my taxes without a W2 form?

No, you cannot file your taxes without a W2 form if you were paid wages or a salary during the tax year. You should contact your employer immediately to have them issue a duplicate form if you do not receive one by January 31st of the following year.

What if I lost my W2 form?

If you lost your W2 form, you should contact your employer immediately to have them issue a duplicate form. If you cannot get in touch with your employer, you can request a wage and income transcript from the IRS. This will provide you with the necessary information to file your tax return.

What if I received a W2 form for a previous tax year?

If you receive a W2 form for a previous tax year, you should check the form to make sure that the information is correct. If the information is correct, you can use the form to file an amended tax return for the previous year. If the information is incorrect, you should contact your employer to have them issue a corrected W2 form.

Conclusion

The W2 form is an important document that every employee receives at the end of each tax year. It contains important information about the employee’s income and the taxes that were withheld during the year. It’s important to take the time to fill out your W2 form correctly and to double-check that all of the information is accurate. If you have any questions or concerns about your W2 form, you should contact your employer or the IRS for assistance.

Remember to keep a copy of your W2 form with your tax records for at least three years. This will ensure that you have all of the necessary information in case you are audited by the IRS. Stay up-to-date on any changes to the W2 form or other tax forms to ensure that your tax returns are accurate and complete.

Remember to keep a copy of your W2 form with your tax records for at least three years. This will ensure that you have all of the necessary information in case you are audited by the IRS. Stay up-to-date on any changes to the W2 form or other tax forms to ensure that your tax returns are accurate and complete.

Thank you for taking the time to read this post. We hope that you found it helpful and informative!

Thank you for taking the time to read this post. We hope that you found it helpful and informative!

Please note that this post is for informational purposes only and is not intended to be a substitute for professional tax advice. If you have any questions or concerns about your taxes, you should consult with a qualified tax professional.

Please note that this post is for informational purposes only and is not intended to be a substitute for professional tax advice. If you have any questions or concerns about your taxes, you should consult with a qualified tax professional.

Remember to file your taxes by the deadline, which is typically April 15th of each year. Filing your taxes late can result in penalties and interest charges from the IRS.

Remember to file your taxes by the deadline, which is typically April 15th of each year. Filing your taxes late can result in penalties and interest charges from the IRS.