Do you know what a 1096 form is? If you’re an employer in the United States, it’s a crucial document that you need to familiarize yourself with. And don’t worry, we’ve got you covered with everything you need to know about this important form.

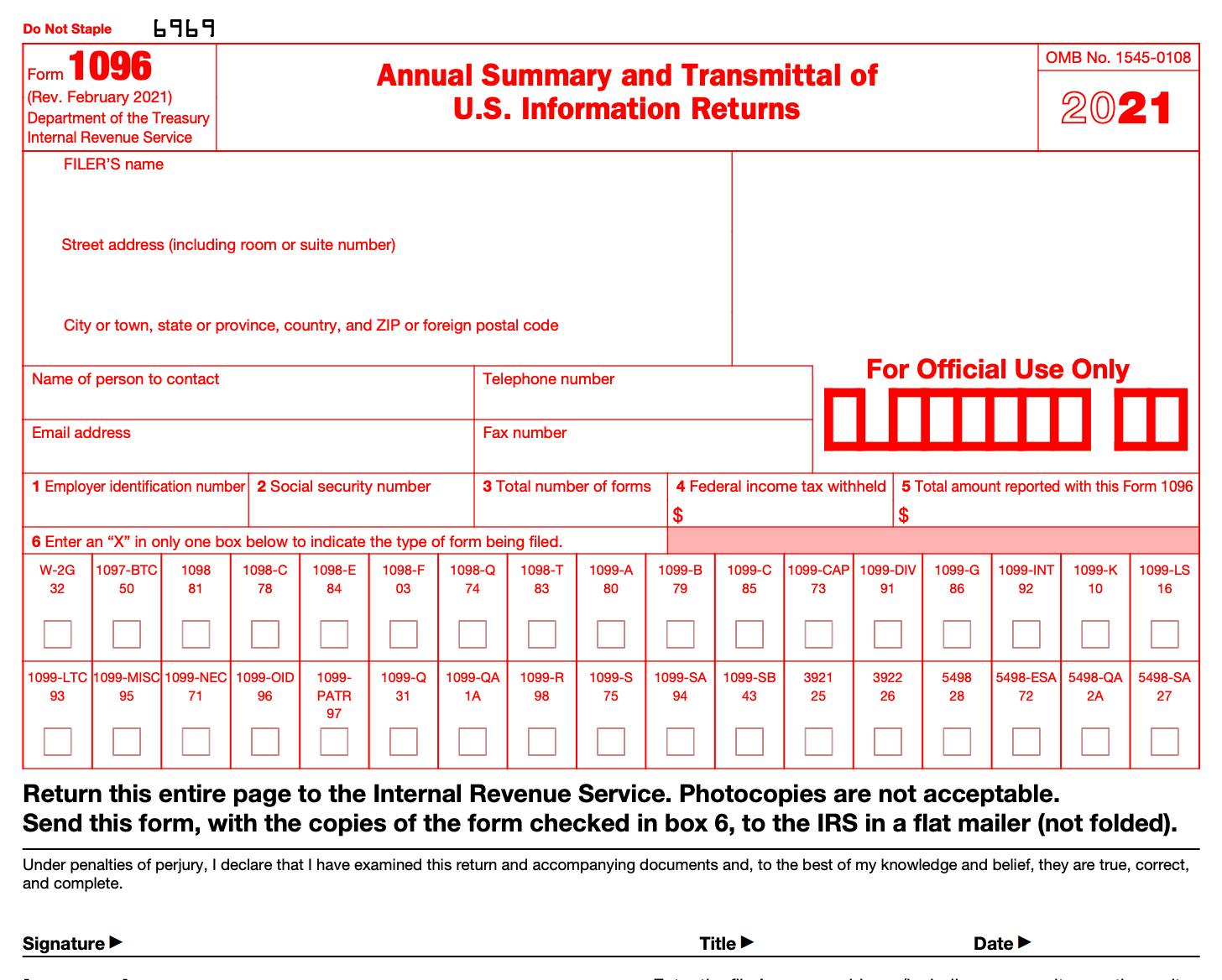

Image 1: What is a 1096 Form? A Guide for US Employers

So, what exactly is a 1096 form? It’s a document that summarizes and transmits the information from the 1099 forms you’ve issued to your independent contractors and other non-employees. The 1096 form is sent to the IRS along with your copies of the 1099 forms. This form is used to report various types of income, including rent, royalties, and proceeds from the sale of property.

So, what exactly is a 1096 form? It’s a document that summarizes and transmits the information from the 1099 forms you’ve issued to your independent contractors and other non-employees. The 1096 form is sent to the IRS along with your copies of the 1099 forms. This form is used to report various types of income, including rent, royalties, and proceeds from the sale of property.

As an employer, it’s important to note that if you’ve made payments of $600 or more to an individual or partnership, you must file a 1099 form to report those payments. And if you’ve made payments of $10 or more in gross royalties or $600 or more in rents or other payments to a landlord, you must file a 1099-MISC form.

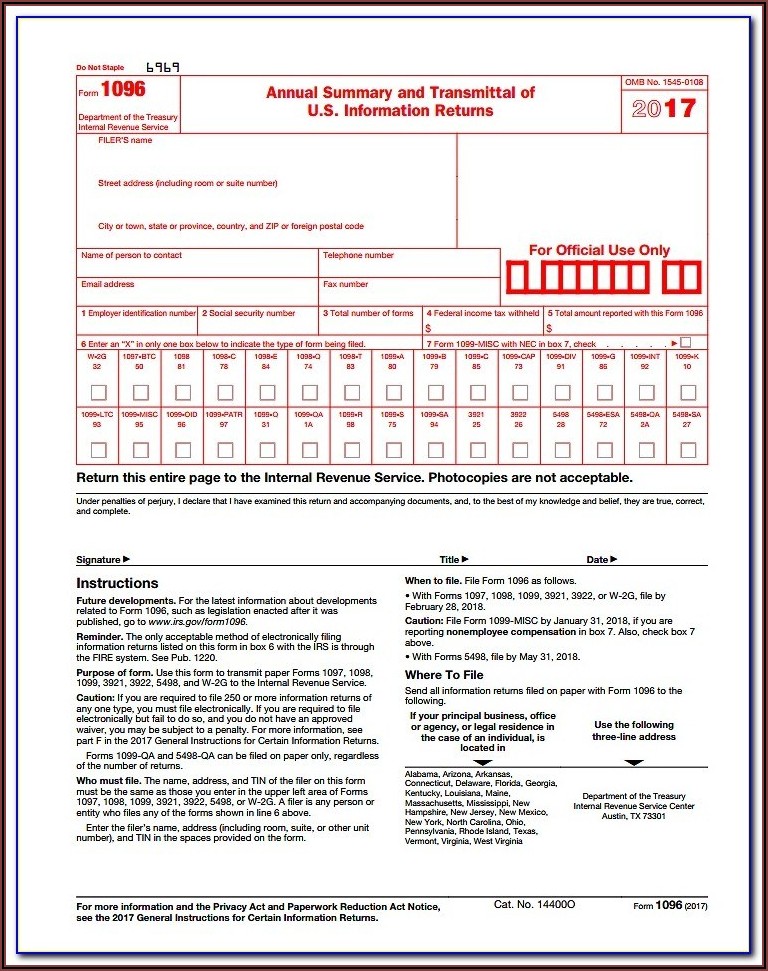

Image 2: Downloadable Irs Form 1096

The 1096 form is an official IRS form that can be downloaded from the IRS website. The form must be completed and mailed to the IRS along with your 1099 forms. When you fill out the 1096 form, you’ll need to include your name, address, and taxpayer identification number. You’ll also need to include the total amount of payments you made throughout the year on the form.

The 1096 form is an official IRS form that can be downloaded from the IRS website. The form must be completed and mailed to the IRS along with your 1099 forms. When you fill out the 1096 form, you’ll need to include your name, address, and taxpayer identification number. You’ll also need to include the total amount of payments you made throughout the year on the form.

It’s important to note that the 1096 form must be filled out in ink, and you must use the correct version of the form for the year in which you’re filing. Using an outdated version of the form can result in penalties and fines from the IRS.

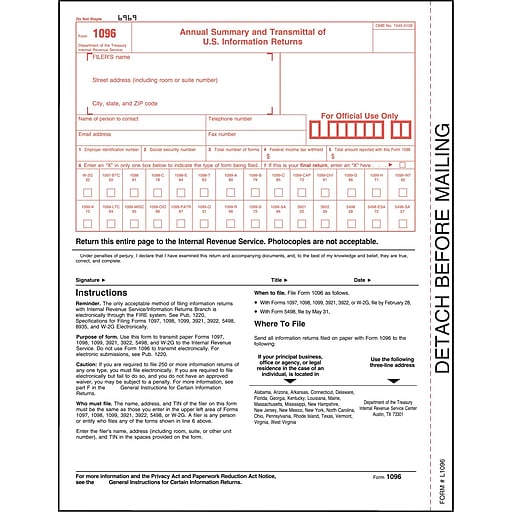

Image 3: TOPS 1096 Tax Form, 1 Part, White, 8 1/2" x 11", 50 Sheets/Pack (L1096)

Another option is to use tax software that will automatically generate and file your 1099 forms for you. This can save you time and reduce the likelihood of errors, as the software will ensure that you’re filling out the forms correctly and submitting them on time. Plus, many tax software programs offer additional features, like year-round tax planning and support from tax professionals.

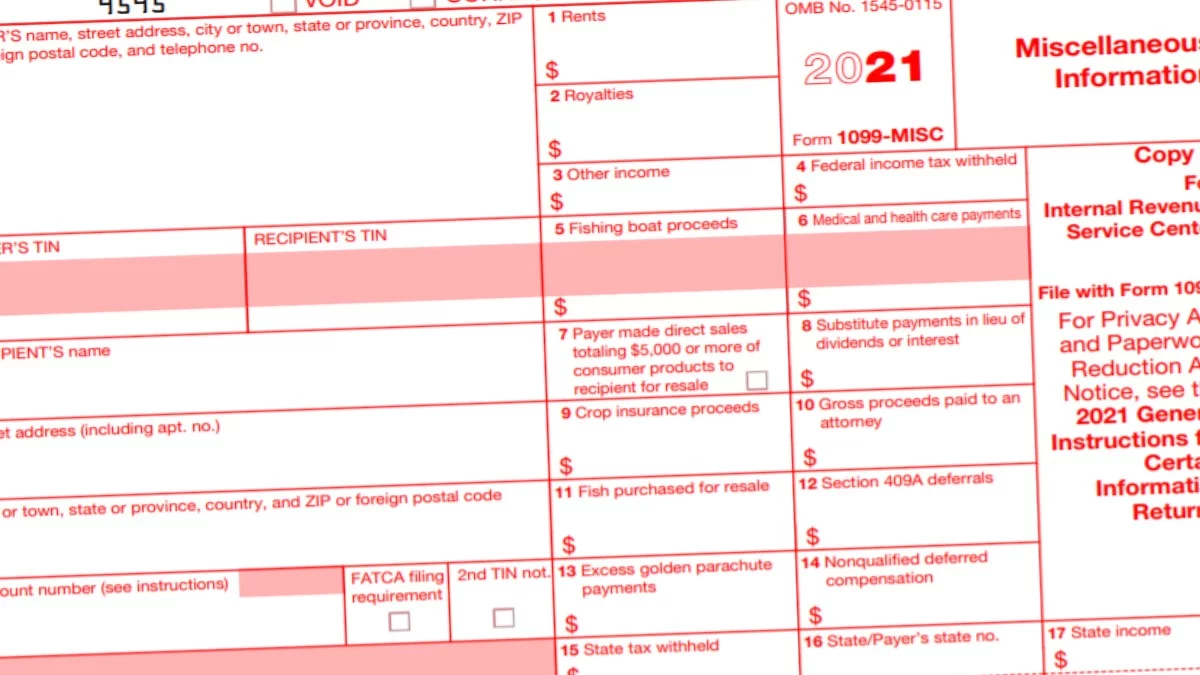

Image 4: 1096 Form 2021 - 1099 Forms - TaxUni

Now, you might be wondering about the specific details of filing your 1099 forms and 1096 form. The IRS provides a detailed set of instructions for filing these forms, which can be found on their website. The instructions cover everything from who needs to file the forms, to what information needs to be included on the forms, to when the forms need to be submitted to the IRS.

Now, you might be wondering about the specific details of filing your 1099 forms and 1096 form. The IRS provides a detailed set of instructions for filing these forms, which can be found on their website. The instructions cover everything from who needs to file the forms, to what information needs to be included on the forms, to when the forms need to be submitted to the IRS.

If you’re using tax software to file your 1099 forms, the software should guide you through the filing process and ensure that you’re following all the required steps. And if you have any questions or run into any issues, you can always reach out to the software provider’s customer support team for assistance.

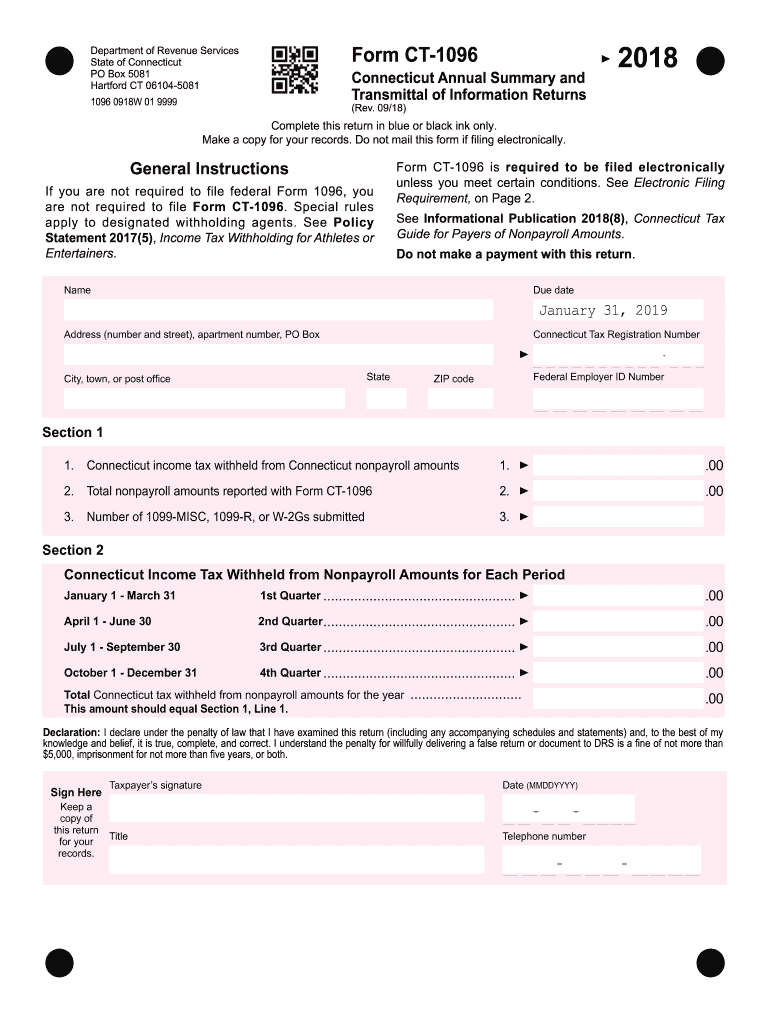

Image 5: Ct 1096 - Fill Out and Sign Printable PDF Template | signNow

One thing to keep in mind when filing your 1099 forms and 1096 form is that you’ll need to keep track of all the payments you made to your contractors and non-employees throughout the year. This means keeping accurate records of all payments made, including the name and taxpayer identification number of the recipient, as well as the amount and type of payment.

One thing to keep in mind when filing your 1099 forms and 1096 form is that you’ll need to keep track of all the payments you made to your contractors and non-employees throughout the year. This means keeping accurate records of all payments made, including the name and taxpayer identification number of the recipient, as well as the amount and type of payment.

Having accurate and complete records will make it much easier to fill out the 1099 and 1096 forms correctly, and will also ensure that you have the information you need in case you need to respond to any IRS inquiries or audits down the line.

Image 6: 1096 Transmittal Form (L1096)

Finally, it’s important to remember that filing your 1099 forms and 1096 form is a legal requirement, and failure to comply can result in penalties and fines from the IRS. Make sure you’re familiar with the filing requirements and deadlines, and take the necessary steps to submit your forms on time and accurately.

Finally, it’s important to remember that filing your 1099 forms and 1096 form is a legal requirement, and failure to comply can result in penalties and fines from the IRS. Make sure you’re familiar with the filing requirements and deadlines, and take the necessary steps to submit your forms on time and accurately.

While filing your 1099 forms and 1096 form can be a time-consuming and sometimes confusing task, taking the time to understand the requirements and ensuring that you’re filing correctly can save you a lot of headaches down the line. And with the help of tax software and other resources, you can streamline the process and ensure that you’re complying with all the necessary regulations.

So, there you have it - everything you need to know about the 1096 form and why it’s so important for US employers. Keep these tips in mind, and make sure you’re in compliance with all the necessary IRS regulations. With a little bit of effort and attention, you can navigate this process with ease and confidence.